Most drivers who have driven on the Jutland-Funen motorway know Fiberline Composites' characteristic building, which is located right next to the motorway at Middelfart. Here, Jesper Sloth was headhunted three months ago for the position of sales director for carbon fibre, which already has a fairly good share compared to glass fibre. He thus left his position as CMO for Polytech in Bramming.

- I have everything in carbon fibre, which makes up 85 per cent of what we produce, says Jesper Sloth, while he shows around the production of carbon fibre planks for the turbine blades.

The production of the planks in different sizes, depending on the size the individual OEM wants, takes place in three shifts on all weekdays of the week. Fiberline has approximately 150 employees in Denmark and around 300 worldwide. In addition to the factory in Middelfart, Fiberline also has factories in China and India.

- We try to produce where turbines are needed, because it makes the most sense, explains Jesper Sloth.

That is also one of the reasons why the company is now looking at possibly opening another factory in the USA. However, the possible future factory in the USA is also being pushed forward by requirements in American legislation.

- It is the Inflation Reduction Act (IRA) that helped create requirements for local content. So now we are working on a setup in the USA to investigate the growth there, says Jesper Sloth about a significant political decision that has kicked off the American wind market.

In the EU, work is now underway on a European counterpart to the IRA in the form of the Green Deal, which will also entail requirements for local content. Here, Jesper Sloth points out that it is one thing to choose local content in relation to blade or tower manufacturers. But it would also make a lot of sense to look down the supply chain and, for example, also require local content down the supply chain for products such as Fiberline's carbon fiber planks.

- You can ask yourself whether there should be a requirement for local content down the supply chain, he says and elaborates:

- If, for example, it applies down the supply chain, then the steel and others would also have to come from Europe. If you look at the entire supply chain in Europe, it makes sense to produce in Europe and in the West. This will increase the profitability of the entire European wind turbine industry.

Fear of dependence on China

Otherwise, there is a risk that China will come to have a heavy burden on the raw material part for both European and American wind turbines. This is an area that China subsidizes, and this could mean that the expansion of both European and American wind will become dependent on China. It is about the profitability of the industry, but it is also about security for broken supply chains.

- If there is one thing we have learned from Russia's invasion of Ukraine, it is to spread out our supply chain, says Jesper Sloth.

In other words, it is geopolitics that could potentially have very major consequences if China were to one day end up in a conflict over Taiwan. This could slow down both production and the installation of turbines in Europe and even in the USA.

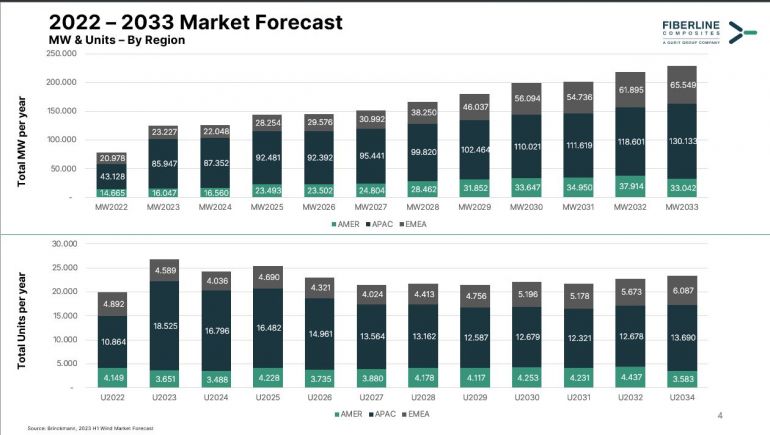

China and the Asian region, also called APAC for Asian and Pacific, are set to install both more wind turbines and MW than both the Europeans and the Americans combined, shows a market analysis from Fiberline. For example, the analysis shows that in 2022, 10,864 wind turbines will be installed in APAC. Europe, the Middle East and Africa (EMEA) and the American market (AMER) will install 4,892 and 4,149 turbines, respectively.

This is a trend that will continue despite the large-scale expansion of offshore wind that has been decided in Europe. However, Jesper Sloth can be pleased that carbon fiber in the blades will take off in the coming years.

- Yes, the longer the blades become, the more carbon fiber is used. All Western OEMs are already using carbon fiber today, concludes Jesper Sloth.

The market analysis from Fiberline shows how more turbines will be installed in Asia and the Pacific than in Europe, Africa and the American market. This also applies to MW.

Article updated 21.06.23 at 17:39

Text, graphics, images, sound, and other content on this website are protected under copyright law. DK Medier reserves all rights to the content, including the right to exploit the content for the purpose of text and data mining, cf. Section 11b of the Copyright Act and Article 4 of the DSM Directive.

Customers with IP agreements/major customer agreements may only share Danish Offshore Industry articles internally for the purpose of handling specific cases. Sharing in connection with specific cases refers to journaling, archiving, or similar uses.

Customers with a personal subscription/login may not share Danish Offshore Industry articles with individuals who do not themselves have a personal subscription to Danish Offshore Industry.

Any deviation from the above requires written consent from DK Medier.