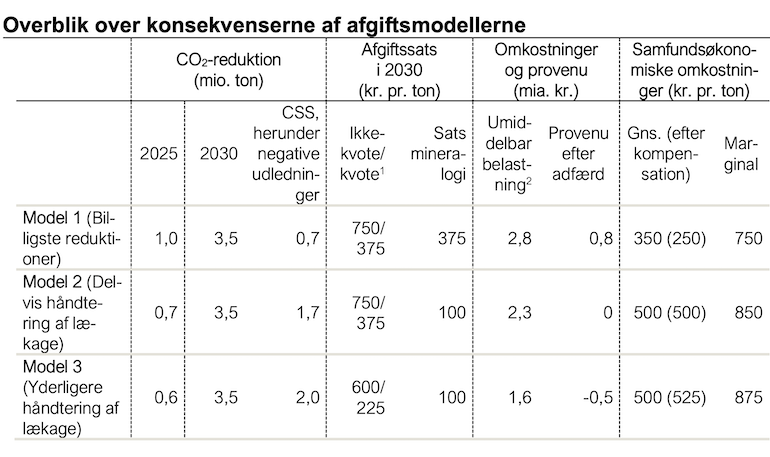

After a year of work, an expert group proposed three models for a new CO2 tax on Tuesday.

One operates with a uniform tax everywhere, which is the cheapest way for society to reduce emissions.

Two of the models are differentiated. This will exempt the largest emitters, such as the Aalborg Portland cement factory, which otherwise risks having to close, and to a greater extent hit companies that emit less, as they will have to bear a larger part of the burden.

- Emissions are very unevenly distributed. The five largest emitters account for 44 percent of emissions. This is a point of attention that we will take into account. We have not been able to find a model that perfectly balances all considerations, so we will present several models, says professor of economics Michael Svarer. He is chairman of the commission.

Will find 3.5 million tons

All the models are set to reduce emissions by 3.5 million tons by 2030. Denmark currently needs to plan for more than nine million tons to reach the political goal.

It is now up to the parties in the Danish Parliament to agree on which model they will continue with to reduce emissions.

The governing party, the Social Democrats, has previously been skeptical of CO2 taxes. But after several years of political wrangling, a majority is in favor of a tax after Prime Minister Mette Frederiksen (S) said in her New Year's speech that there should be agreement on a CO2 tax this year.

She promised "a new and ambitious tax on CO2". The tax will be the largest contribution to reducing CO2 emissions by 70 percent by 2030, which is a political goal.

Your tax can affect production

It is economically cheapest to choose a uniform rate for a new CO2 tax.

However, the experts at the forefront fear that it will lead to a decline in production among the country's companies and a risk that they will move production abroad.

Michael Svarer, however, does not believe that Danish companies need to close as a result of a new CO2 tax system.

- Models two and three are a tax level that has been increased, but it is not to an extent where they must close. We believe that Danish business can be developed on the basis of these models and should not be phased out, he says when presenting the three models proposed by the expert group.

The environmental economic sages have proposed a uniform CO2 tax of 1,200 kroner per ton. The Climate Council has proposed 1,500 kroner.

Chart from the report showing the three models. Leakage should be understood as the risk of companies moving production abroad.

Read the entire proposal here

Ritzau / ak

Text, graphics, images, sound, and other content on this website are protected under copyright law. DK Medier reserves all rights to the content, including the right to exploit the content for the purpose of text and data mining, cf. Section 11b of the Copyright Act and Article 4 of the DSM Directive.

Customers with IP agreements/major customer agreements may only share Danish Offshore Industry articles internally for the purpose of handling specific cases. Sharing in connection with specific cases refers to journaling, archiving, or similar uses.

Customers with a personal subscription/login may not share Danish Offshore Industry articles with individuals who do not themselves have a personal subscription to Danish Offshore Industry.

Any deviation from the above requires written consent from DK Medier.