From 2030, Danish agriculture will be subject to a CO2 tax.

The government and a large number of interest organizations agreed on this in the green tripartite agreement on Monday evening. This is stated in the agreement text, which the parties presented at a press conference at the Ministry of Economic Affairs.

The parties have agreed that from 2030, agriculture will have to pay 300 kroner per ton in CO2 tax. The tax will then increase to 750 kroner per ton in 2035.

But there will also be a floor deduction for agriculture, which changes the real tax rates.

- With a floor deduction of 60 percent, this corresponds to the effective tax rates being 120 kroner per ton CO2 in 2030 and 300 kroner per ton CO2 in 2035, the text of the agreement states.

The floor deduction must be introduced so that there is "a connection between the tax burden, the actual options for action and the incentive to use them".

The proceeds from the CO2 tax will go in 2030 and 2031 to investments in climate technology and production conversion targeted at farmers who are "hit hardest" and have "difficulty adapting ".

Minister of Economic Affairs Stephanie Lose (V) says at the press conference that the green tripartite agreement lays the foundation for Denmark to reach the 2030 target, and ensures better nature and water environment, but also "good space for good and solid food production."

New land use

The agreement in the green tripartite also includes the establishment of a fund called the Danish Green Land Fund. 40 billion kroner will be allocated here, which the government will now "work to find".

The billions will, among other things, go towards the establishment of 250,000 hectares of forest by 2045.

In addition, "strategic land acquisition" will take place, and support will be provided for the removal of 140,000 hectares of low-lying land by 2030.

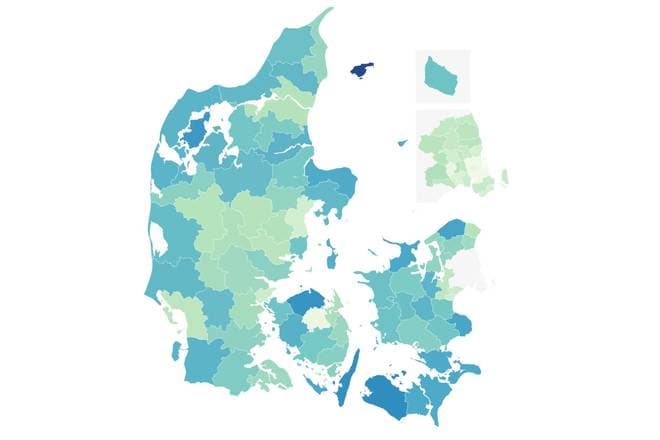

- With the establishment of the Denmark Green Land Fund, we are setting aside 40 billion kroner for a huge restructuring of the map of Denmark, says Stephanie Lose.

Foreign Minister Lars Løkke Rasmussen (M) states that it is an agreement that "will not pass".

- As a politician, you must be careful not to use paraphrases and say that it is historical. I just have to say on my own behalf that I have lived a long time, but I do not remember having made an agreement with political awareness that what we have agreed on today is something that stands, he says.

Tax Minister Jeppe Bruus (S) takes it further and calls the agreement "world history".

Incredibly delicate balances

The agreement in the green tripartite comes after a year-long process on CO2 taxes.

Back in December 2020, the Danish Parliament adopted a green tax reform that entrusted the design of specific CO2 taxes to an expert committee of prominent economists.

This initially led to the Danish Parliament being able to adopt a CO2 tax of 750 kroner per ton in the summer of 2022 CO2 for industry.

Since then, the tax on agricultural emissions has been postponed time and again. The expert committee itself has needed more time, just as the establishment of the green tripartite has dragged on.

The tripartite was born at the end of 2023 as an attempt by the Liberal Party to resolve the fundamental disagreements about agricultural climate regulation together.

Among the interest organizations in the green tripartite are the Danish Food and Agriculture Association and the Danish Nature Conservation Association.

Even if the tripartite has reached an agreement, it still needs to be presented and adopted in the Folketing. It will only be on the other side of the summer break, when the Folketing opens for legislative consideration again.

- We are now very much looking forward to being able to have a good dialogue with the parties in the Folketing about the further process from here, with the hope that we can also find the incredibly delicate balances there, says Stephanie Lose.

The main points of the agreement here:

- Reductions of greenhouse gas emissions of 1.8 million tons of CO2 in 2030 - and potential for up to 2.6 million tons.

- A CO2 tax on emissions from livestock. A tax of 300 kroner per ton of CO2 will be introduced in 2030, increasing to 750 kroner per ton of CO2 in 2035 with a base deduction of 60 percent. The effective tax will thus amount to 120 kroner per tonne in 2030, increasing to 300 kroner per tonne in 2035.

- Return of proceeds to the industry: The proceeds from the livestock tax in 2030-31 will be returned as a transition support pool to support the industry's green transition. Handling of the proceeds will be revisited in 2032.

- Establishment of the Danish Green Land Fund, which will include activities worth approximately 40 billion kroner.

- Establishment of 250,000 hectares of forest (equivalent to an area the size of Lolland-Falster and Bornholm).

- Removal of 140,000 hectares of carbon-rich lowland soils including marginal areas.

- A target of at least 20 percent protected nature. The creation of 80,000 hectares of private virgin forest, 20,000 hectares of state forest and the removal of low-lying soils will significantly increase the extent of protected nature.

- A subsidy scheme totaling just over DKK 10 billion towards 2045 for the storage of biochar produced by pyrolysis.

- A paradigm shift in nitrogen efforts, where land conversion is the main driver for achieving the goals of the EU's Water Framework Directive.

- Abatement of fees for slaughterhouses for DKK 45 million annually with effect from 2029 and a pool for upgrading of a total of DKK 100 million over the period 2027-30.

Source: Ministry of Economic Affairs.

/ritzau/mar

Text, graphics, images, sound, and other content on this website are protected under copyright law. DK Medier reserves all rights to the content, including the right to exploit the content for the purpose of text and data mining, cf. Section 11b of the Copyright Act and Article 4 of the DSM Directive.

Customers with IP agreements/major customer agreements may only share Danish Offshore Industry articles internally for the purpose of handling specific cases. Sharing in connection with specific cases refers to journaling, archiving, or similar uses.

Customers with a personal subscription/login may not share Danish Offshore Industry articles with individuals who do not themselves have a personal subscription to Danish Offshore Industry.

Any deviation from the above requires written consent from DK Medier.