UPDATED: Andel has had a few profitable years, the latest accounts, due to the very high prices in the energy industry. But now these are more back to normal, and for the energy and fiber network group this has also meant that the first half of 2024 has not been profitable.

Thus, Andel lost 130 million DKK before tax in the first half of the year. The result has been negatively affected by varying energy prices, high material prices and the interest rate level. Also, a type of European gas capacity contracts, which the energy trading company Energi Danmark entered into and made a lot of money on in 2022, resulted in a loss in the first half of the year, but ends up being a very good business overall.

The result was realized by a turnover of 42.1 billion DKK in the first half of the year. This is significantly lower than in the first half of 2023, when it was 69.9 billion DKK, due to lower energy prices. DKK

These factors are causing Andel to downgrade its expectations for the year's result from the previously announced profit of DKK 300 million to a lower result, which Andel informs DOI.dk will be closer to zero than DKK 300 million - although still positive.

Despite the decline in earnings, Andel maintains its ambition to invest more than DKK five billion across the group and its subsidiaries, which is a historically high level for the group.

- We will not let high interest rates, material prices and other economic fluctuations become an excuse for passivity. The climate crisis does not wait for better times. We owe it to the planet and future generations to invest massively in renewable energy and infrastructure. And we see our investments as action on the words that we will take leadership in a greener and more electrified future, says Andel's CEO, Jesper Hjulmand, in a press release.

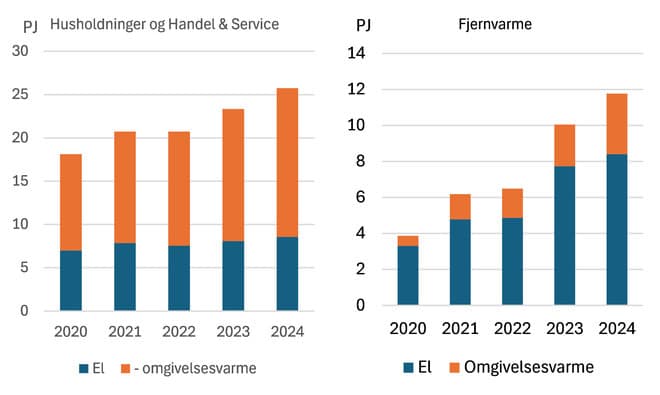

In the first half of the year, Andel has invested approximately DKK 2.3 billion compared to DKK 1.5 billion in the same period last year. Among other things, DKK 922 million has been invested in expanding the electricity grid on Zealand, Lolland-Falster and the islands via the grid companies Cerius and Radius Elnet, DKK 397 million in the construction of solar parks together with Better Energy and DKK 371 million in Clever's expansion of Denmark's largest charging network for electric cars.

Layoffs in Andel Energi

However, the negative result and the downward adjustment will not be allowed to go untouched. Andel thus indicates that "it creates a need to reduce costs and increase earnings."

The adjustment is, among other things, happened on Wednesday at Andel Energi, where CEO Marlene Holmgaard Fris states that there has been a round of layoffs.

"Unfortunately, we have had to say goodbye to good colleagues. This is due to several things. Firstly, the energy market has changed in recent years. Competition has become fiercer, and it has become more difficult to run an energy company. At the same time, the outside world is making increasingly greater demands on energy companies. All of this requires that we as a business develop and change our focus so that we can also meet the demands of customers and the outside world for a modern energy company in the future. Therefore, this week, we at Andel Energi have changed our organization to suit a future energy market that is facing increased commercialization," she writes in a post on her LinkedIn profile.

Andel informs DOI.dk that 29 employees are included in the layoff round.

Andel indicates that an adjustment is necessary to maintain the current investment ambitions.

- Since our large investments also affect the bottom line, we have naturally discussed whether we should continue at the same speed or ease off a little. But here the ownership form as a cooperative really shows its value, says Jesper Hjulmand and continues:

- With a strong backing, we value the responsibility of creating a greener future over tightening short-term profit. We are financially robust, and there is strong support for not thinking this year, but decades. For the benefit of both the Danes, the green transition and Andel's future.

Andel's equity is also robust and amounts to over 30 billion. DKK.

Text, graphics, images, sound, and other content on this website are protected under copyright law. DK Medier reserves all rights to the content, including the right to exploit the content for the purpose of text and data mining, cf. Section 11b of the Copyright Act and Article 4 of the DSM Directive.

Customers with IP agreements/major customer agreements may only share Danish Offshore Industry articles internally for the purpose of handling specific cases. Sharing in connection with specific cases refers to journaling, archiving, or similar uses.

Customers with a personal subscription/login may not share Danish Offshore Industry articles with individuals who do not themselves have a personal subscription to Danish Offshore Industry.

Any deviation from the above requires written consent from DK Medier.